Q&A

Question 1: Solar energy

If renewable energy like solar is cheaper than others that are not renewable, then why isn’t everyone around the world implementing them?

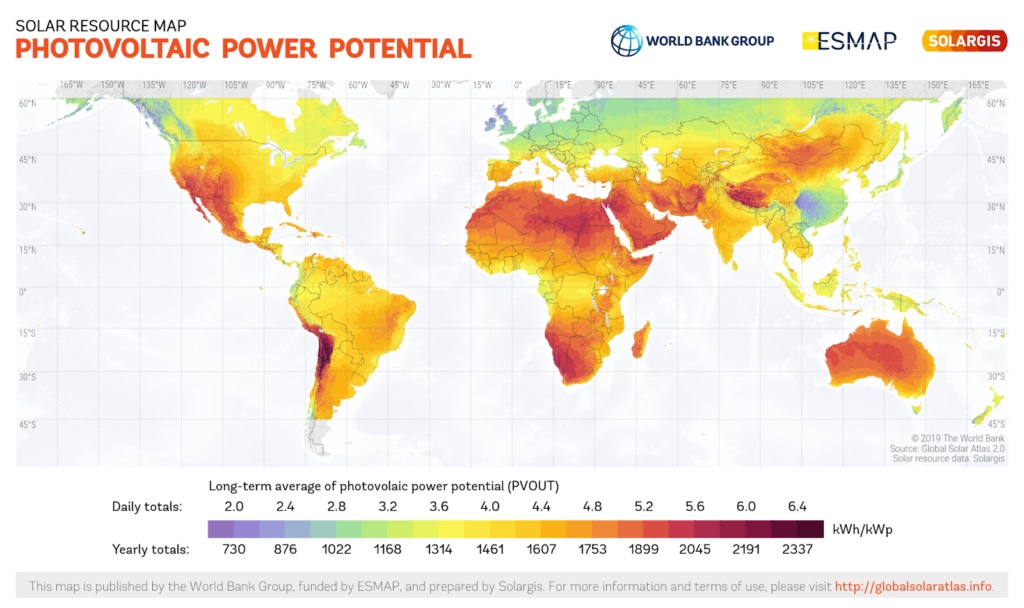

Actually everyone around the world is implementing solar. If you look at Wikipedia, it is constantly updated with information about what are the deployments of solar energy, both in terms of total capacity as well as how much a given country added last year because not only what is already available is growing, but how much we are able to add every year is growing as well. Obviously, steel photovoltaics is not a very large percentage of our energy production., but within the electricity production it is starting to be significant. It keeps growing together with wind and battery technologies, they are expected to be outpacing the projections of even the most aggressive proponents of these sources. the perception that it is not growing as fast as it could, comes from three reasons. One is that the volume, the numbers are still low, so an increment, even if exponential of a low number, still looks like if it were very low, almost insignificant. The second reason is because it is not evenly distributed. There are many countries that are progressing rapidly, but others, and it is especially surprising in some ways in places like Africa, they are absolutely lagging behind. The reason why it is surprising in Africa is because, obviously, Africa is one of the most, and one of the areas, that would benefit the most from solar, if we look at the potential. The third reason is that the inertia of industrial systems is very high to admit that you should better close a carbon plant or a gas plant, rather than spending in its upkeep or its upgrade and billing. A solar plant equivalent with a battery storage system to what you are replacing takes a lot of courage, and some companies have that kind of courage, for example, ENEL is not planning to update its carbon plants, they are planning to completely phase them out. This was already decided years ago and they are fully going ahead with dismantling carbon plans, rather than spending money to make them compliant with the European Union regulations on carbon and CO2 emissions. This is an example where the industrial inertia is not enough to stop the change, and in Italy electricity production from solar reaches very, very high percentages and as one of the more advanced countries deploying it. That is the answer to the question and the pace is exponential. We are still at the beginning. Everywhere the change is happening but not evenly across.

Question 2: World’s energy need

Assuming the most efficient panel technology today, what area do we need to cover to satisfy the world’s energy needs?

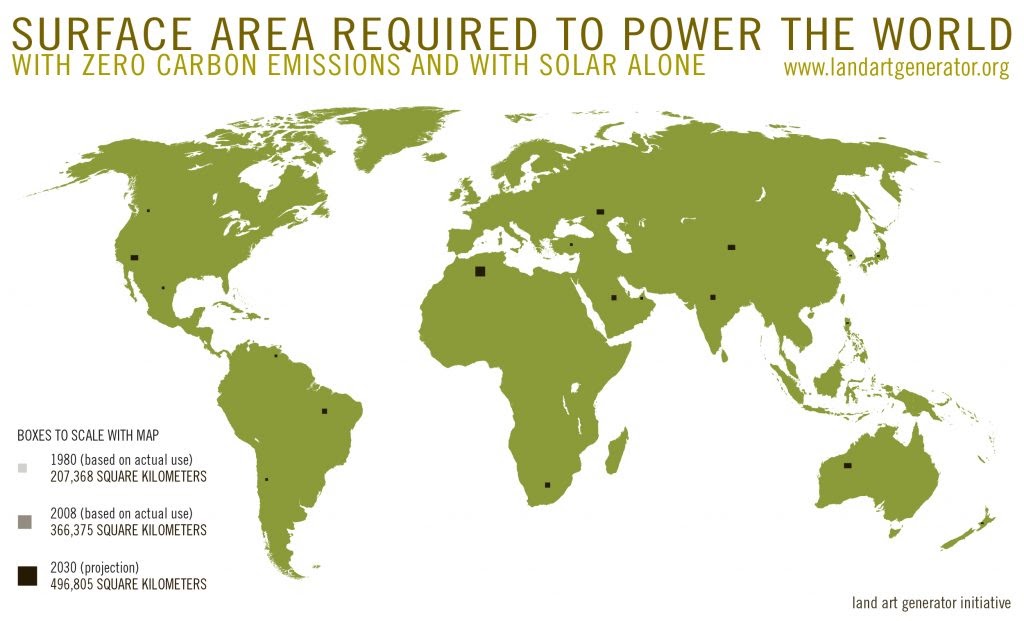

It is really amazing that we only need this amount. Only the dark amounts would need to be covered with solar plants and we would be able to power the world. The fear that some may have is that we cannot move to solar because we have to cover all the surface area with the panels, and this is not based in reality. What is also interesting is that there are opportunities for people who feel that they want to take advantage of the solar level revolution, but they cannot participate, because the solar energy generation and the financial benefit of that don’t have to take place in the same geographical area. Sun Exchange is a company that is based in South Africa, one of the best places in the world for solar energy (Full disclosure: it is a company where I invested and I’m an advisor). The way it works is that you can participate in the solar projects that they are building locally replacing the CO2 emitting generation, often diesel generators, very dirty sources of energy, for schools, for villages, for shopping centers, for an Elephant Sanctuary…so many different projects and you can support the project owning a solar cell and benefiting from the profit the solar cell generates getting the payment of that in your Bitcoin wallet. You put in, let’s say, $10, $100, $1,000, and you will receive a monthly payment of the solar energy generated as a consequence. This is an example of how the solar revolution is not for only those who can afford it, and it is not restricted to specific geographical areas, but everyone can participate.

Question 3: David’s hand chip

What does the little computer in your hand to do? Can you tell us more about it?

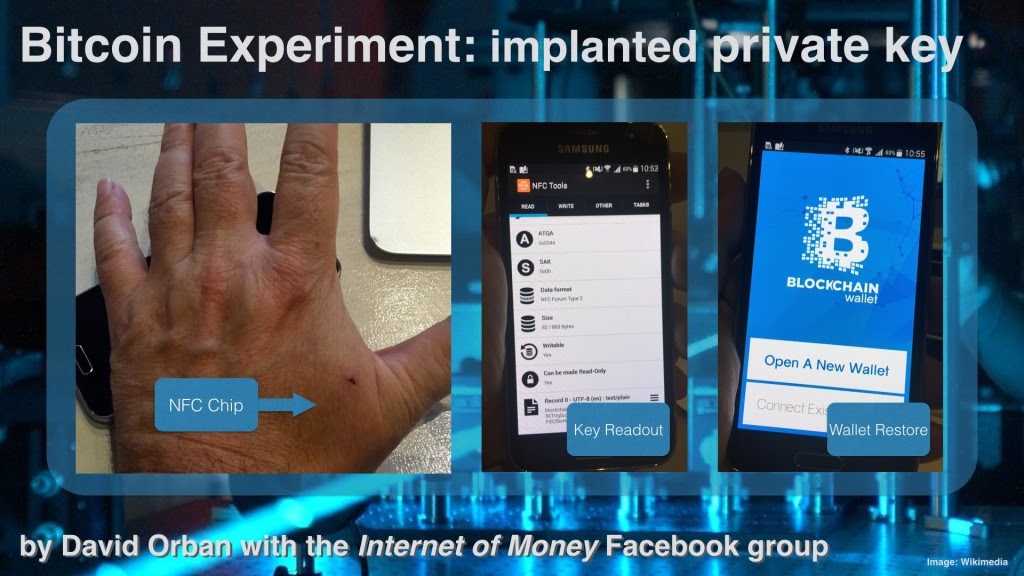

The important thing about the chip that I have is not what it can do today, but really what it represents, even though it can do a few things today as well. First of all, the chip is installed in this area of my hand between the two fingers, and the chip itself is in a glass vial. The glass vial isolates it from the environment of the body. It is completely self contained, and it is important that it doesn’t have a battery, so it doesn’t need to be recharged or replaced. The energy that it needs for computation and doing everything that it does is itself received from the outside. The examples of things that can be done with it are really many fold. For example, there is a co working space in Stockholm called Epicenter.

They have become very excited with the chips. They offered everyone to put it in their hand if they wanted to, and 300-400 people accepted. And today at Epicenter, If I go, I can open the doors, pay for coffee, work the photocopier, book a meeting room, exchange my contact information with other people at the office. The news is from today, one of my Friends who was the director of Epicenter, created a company called Dsruptive (that’s his name Hannes Sapiens). Hannes founded Dsruptive after being the director of Epicenter, and they just received a €400,000 investment in order to develop the next generation of chips that are going to glow under your skin. As they do their thing, there will be a light: green, red, blue or yellow, depending on what they do. Another thing that I did with the chip is, for example, to keep the private key of a Bitcoin wallet. It is possible to separate, and we will have a course all about Blockchain and Bitcoin all those things, the wallet, what is the public key and what is the private key, and if you have $10 in your wallet it is not a problem, if you have $100 is not a problem, but if you have a large amount, you don’t want neither to leave the private key on an exchange online, nor you want it on a piece of paper where it could burn down with your house. You want to keep it in as safe a place as possible, and this is pretty pretty safe. And of course there are additional passwords etc, but I implanted the private key to my Bitcoin wallet in my hand. In the future, there will be many other applications. Many of you may have seen the announcements around Neuralink, that is a company that is building brain computer interfaces, more advanced versions of this chip, that rather than being implanted in the hand, are implanted in the head. We will see, and the implications of this are going to be really manifold, and it will take decades to develop and to really understand. In the meantime, if any of you are curious and want to experiment, the way I experimented, the website to purchase one of these chips is called Dangerous Things. You can go to dangerousthings.com and purchase one of these chips or other things as well, no they are not dangerous, but it is cool to believe that they are in to purchase something on their website that is called Dangerous Things, and and then you can experiment and and you can do the crazy things that I am showing you here. These are the latest versions. By the way, to install them, the best is to go to a piercing studio. You go there with the chip and you tell the guy what you want and he will freak out.

What is interesting about this is that you would think they are the revolutionaries, they are the people who protest and cancel culture, but if you bring them one of these chips they will freak out. They will be very, very afraid: “What do you really mean by one thing to become a cyborg?” However, the most important point about the chip is that when I am physically together at a conference with people who are listening to me, and I talk about it on stage, I tell them: “Listen, when the conference is in a break, maybe we have lunch and you are curious, you can come and you can touch the chip under my skin”. The audience very sharply divides between those who are curiousa and really want to feel it, and the others who already have nightmares, even just hearing about it, and they would never want to touch it. What that means is: “Okay, they are not touching the chip, but they are touching the limits of their own adaptability”. They arrived at a point where they feel if society moves over, they want to stay behind. They don’t want to go where society’s going. Nobody is planning to put these chips in everyone, I can assure you, we already have an obligation to put similar chips in each of our dogs, at least in Europe, but there will be a point where having an implant will represent a huge advantage. Similarly to being able to drive a car today, if I am running without a car and you are running with a car, you will always win. If I have to think without an implant and you think with an implant, you will always win. And that is what we have to discuss, relative to Neuralink for example, before they become ubiquitous.

Question 4: Customize the chip functions

How can you configure your chip? Can we program the chip to run new scripts or functions?

Yes, the chip is based on NFC, and it has a tiny memory today, but within the constraints of that memory, you can actually program the chip. You can store things, you can compute, you can communicate…Absolutely, it is possible to program it.

Question 5: DNA sequencing

Given the DNA sequencing will allow insurance companies to better know the risk of each person. Are they going to be able to differentiate among us and maybe deny coverage? How can we assure equal access to affordable health for all?

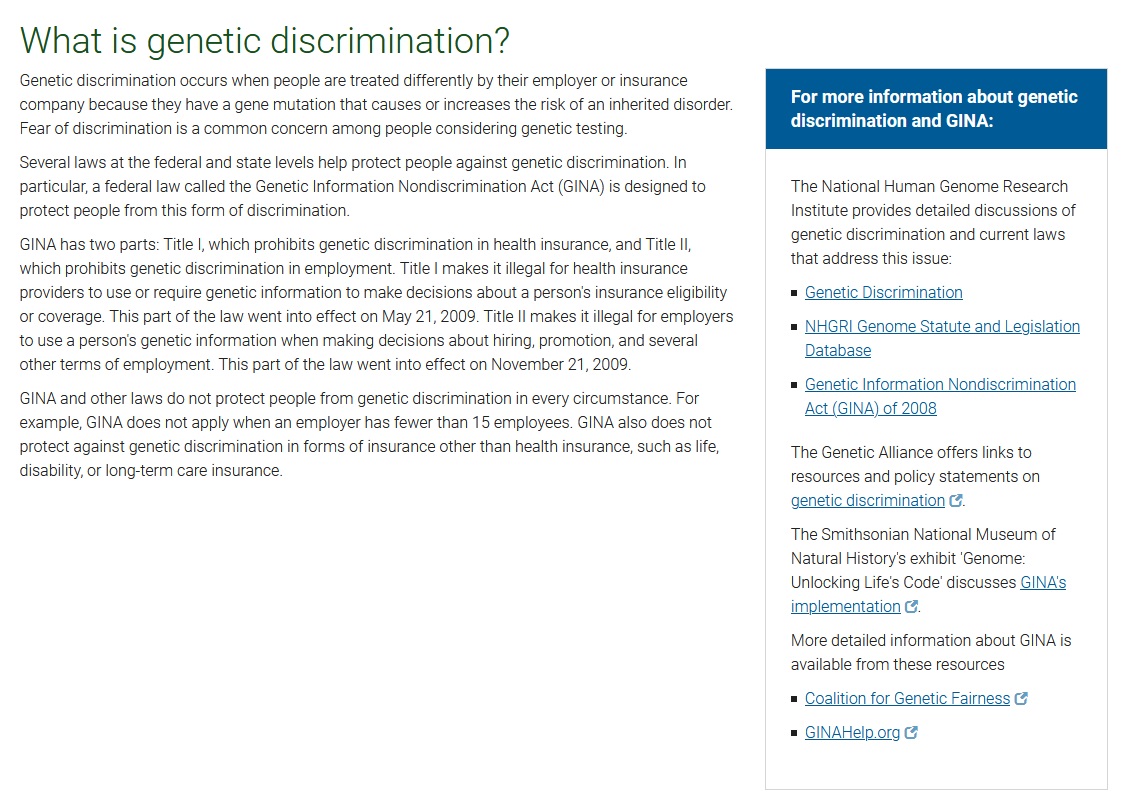

These two questions look on one side to society, on the other side to the business models and how they must co-evolve, how they must both change. In many countries, there is already a law prohibiting genetic discrimination. Both in the European Union, as well as in the United States, you cannot offer a differential service to people who can be identified as for example, carrying a gene that exposes them to some condition. However, as we know, the law is not enough. How it is implemented and how not only insurance companies but also employers respond is still an absolutely open question.

The law was put in place already 10 years ago, and this particular article that I’m showing you from the National Institute of Health health in the US talks about genetic discrimination.

And the second is this article in Nature, the European journal of Human Genetics. This article is from 2003 17 years ago, and it is still something that is in many ways an open question. The pace of regulation is notoriously slow. In your case, it is also very important: your seeds must receive approval in various geographies in order to be able to do what you do, and it is, of course, something that we want to go as fast as possible, but not faster. Or, if it goes fast, for regulation to be rapidly reviewed, and changed. I think to answer the question about the ability of insurance companies to adapt is that they are not going to be able to adapt. New types of insurance companies will be born, and those are going to be able to take advantage of this. Similarly to how Neobanks are going to capture the business from traditional banks. Another example of an insurance market is for self driving cars. How are you going to cover a Tesla when it is on autopilot, and the probability of crash is radically lower? None of the traditional insurance companies are able to take that into account, and that is why Tesla is actually creating an insurance company. They have the data, they know how you are driving, they know both the statistics and your specific behavior, so they can offer you an advantage of a 20-30% lower quote than anyone else. The likelihood that traditional insurances are going to be able to adapt to this age of genetic information in my opinion is very low.

Question 6: Exponential technologies and insurances

What impact will IoT and AI, together with the Blockchain, have on the data availability for the insurance companies? I know there is an Italian company, or factory, that was able to get a live or was working to get a live or was working together with a bank to get an insurance company to get a live quote, on the risk of their production line.

AI, Blockchain, Internet of Things and the insurance and finance as well as the design of business models are all interconnected. Let me tell you about the example that Jony mentioned.

What is interesting is that the initiator of this is not even a company, it is the bank itself. It is a very interesting private bank called Sella, that was born 300 years ago, originally they were in the textile business, so they had a lot of relationships with the shepherds, who would go in the mountains for 6 months then come back, and and they wouldn’t be able to manage money, so they will always need loans and they will trust the people buying the wool. And that is how from the textile business they went into the finance business and the banking business. 300 years later, they are a very important Italian private Bank, Banca Sella. As a matter of fact, they invented what became PayPal 10 years before PayPal, and they were not inSilicon Valley, but since then they learned the lesson and now they have an accelerator, they have an incubator, they have a venture fund…So they are riding the waves of technological innovation. In the 60s, they bought their first mainframe, and it was so expensive that a lot of their clients left the bank because they felt the bank would go bankrupt by trying to move from manually balancing the books to computerize what they were doing. But the bank was right: they thrived through adopting computers. And today, the bank feels that they have to make a similarly big bet. They feel that the Internet Of Things, with Blockchain and Artificial Intelligence, will provide the next generation of tools. I was sitting with Pietro Sella, the head of the whole organization, and he was telling me: “Imagine if you came to me and asked for a loan for a new production line, let’s say10 Million Euros. What I would have done in the past is to ask you for your balance sheet from last year, and maybe I would have called a credit agency and ask how was your credit rating, complementing the balance sheet information with the credit rating from the agency. But the credit rating agency bases their analysis on the same document on the balance sheet. So in any case, my decision of giving you alone would be based on a year old data. And as a consequence, I would have needed to calculate the interest based on that assessment of risk, a imprecise assessment of risk. As an alternative, what I offering to you, said Pietro to the hypothetical industry asking him for a loan for a new production plant, is to install sensors In your production plant, connect the bank systems to the sensors in your production plant, certify the data on a Blockchain, private or public doesn’t matter, and to be able to see real time, if your production plant is working: are you getting the raw materials? Are you producing whatever gadget you are selling? And then of course, your accounting system: What are your receivables? What are your payables? How is it going? What are the balances looking like not after a year, in real time. And then of course, I have all the algorithms to massage the data in order to understand what the data means. If you are ready, I am ready to radically reduce the interest and to even go at the smaller interest if rather than negotiating a fixed rate, you are ready to accept an interest rate that is adjusted every day or every hour.” That is where we are going with these tools and of course, that interest rate will be 50% lower, or 70% lower, than not what is offered today.

This is a bank that is courageous enough to have created a neobank and that is likely to be much more valuable than the traditional bank very soon, because these Neobanks are being valued very, very large amounts. I don’t know what’s the popular in Argentina but Revolut and N26, and many others are taking the world by storm.

Question 7: Organizations and technological accelerations

How can an organization best anticipate the changes that are coming due to the technological acceleration? Or even, as we say, the increasing rate of acceleration of technology?

It is absolutely hard. One of the good book that has certainly been translated into Spanish as well is “Exponential Organizations”. This book was written by Salim Ismail, together with Michael Malone Yuri Van Geest. Salim was the founding Executive Director of Singularity University, and it is a very good book analyzing exactly this question. Why certain companies are thriving, while others are completely unable to cope with this situation. What happened is that they created an organization called Open EXO, that you can look up, that shares knowledge about this. It would take not one course, but an entire series of seminars to transfer you all the information around this. One important component that I want to highlight is that successful organizations are naturally conservative. It takes effort to maintain the innovation and the creativity. And sometimes successful organizations will kill innovation, and they will push aside the people who are creative and who want to take risks. A middle manager will say: “No, the next quarter target will be reached, and then the next quarter target will be reached, and then the next quarter target will be reached. I don’t have the time or the predisposition to worry about the disruptive revolution you’re telling me. I don’t want to hear that.”

The smart organizations isolate the innovators, they protect the creative individuals, so that what they do. and the risks they take, are not killed by the immune system of the organization. That is one of the ways that organizations can protect these risk taking individuals and then learn from them and adopt what they create more broadly. There are of course, many other things that can be done, but I think that this is, this is an important thing to start with.

Question 8: Exponential acceleration in selling products

¿Cómo ve la aceleración exponencial en negocios que solamente venden productos producidos por la misma compañía o de terceros? En países desarrollados y no.

I think that the starting point for answering this question is: are we talking about physical or digital? Because absolutely the future of physical retail is hard. I’m not saying impossible, but very hard. Even in countries where online sales were already advanced, like the UK or US, thanks to the pandemic, there were increases of 20-30% in the online sales, which was lost, of course, by retail, physical retail. That increase is never going to go back. But on the other hand, if we are talking about online stores, it doesn’t matter what they are selling, whether they are selling their own products or products of third parties, they are embodying exponential change if they are good, and you can see it in their stock price. Amazon is an online store selling third party products mostly, and a few of its own products, and this is exactly an exponential chart of the stock price of Amazon. The market cap of $1.5 trillion.

What is important is that even if many people are saying that Amazon has a dominating position and maybe it should be broken up, just like Apple, and Google, and Facebook, they are not dominating everywhere; I don’t think that Amazon is dominating and Mercado Libre in Argentina is losing. Mercado Libre is riding the exponential change. There you go, another exponential curve. An online store, that is riding exponential changes, just like Amazon, and itis worth $50 billion today. It was able to ride out whatever this crisis was, it was able to ride it out and to go to new heights.

Question 9: Resistance to bureaucracy

How can an organization neutralize bureaucracy and increase its resistance to it?

In Italy, periodically, there are news clips in the daily television news about an employee of whatever Ministry that has been caught, during work hours, when he or she was shopping in the beautiful open markets of Rome. When interviewed by the journalist, she would say: “Oh no, but I am going to go back. I just stepped out, and it is just…” And it turns out that’s what they are doing every day: they are investing a lot of their time in personal matters, rather than being at work. My answer to that? Let them. It is almost like Universal Basic Income to these employees. I want them not to be at work, because it is human nature. If they are at work, they want to prove that they serve some purpose, and the purpose would be to create procedures, over procedures, over procedures ever more complicated and ever more useless. If they are not there, then they cannot. Of course, this is an exaggeration, but there are in many countries attempts for simplifying bureaucracy, even simplifying legislation. And one of the most aggressive attempts for simplifying legislation has been actually carried out in Argentina, where a specialist in Artificial Intelligence and law put together an initiative to analyze which laws in Argentina were actually needed. He concluded that 80% of the laws were not needed, and then he was able to have a proposal in the Argentinian Senate passed to cancel 80% of the laws and his name is Antonio Martino. It’s an amazing initiative, and I don’t know if it ended well, I don’t know if the other branch of the Parliament passed it or not passed it. I don’t know if actually the laws in Argentina have been reduced 80% or not. But simplification is possible, and it is one of the ways for reducing this resistance. Another simple way is to only adopt rules, those so-called sunset clauses. A sunset clause, or a sunset provision is a measure that provides that the law will be eliminated after a specific date, unless explicitly, it is confirmed to still be valid. It is a little bit similar to what Jeff Bezos does when he discusses propositions internally at Amazon: they have a principle that if you want to do something, you only have to provide a very short explanation, If you want to stop someone else from doing something, then you have to write a 10 page report about why they should not do it. That is also a very smart way of eliminating resistance by bureaucracy to making it harder for bureaucrats then the others.

Question 10: Proof of work technologies

Which ones do you think will be the new proof of work technologies or companies involved in Bitcoin or Blockchain that will be able to succeed?

What Bitcoin is accused of is wasting a lot of energy, is not is not a bug, is a feature. The proof of work of Bitcoin is not going to be substituted by other approaches anytime soon, because the balance of incentives actually depends on the way it works. If it were easy to prove a transaction in Bitcoin, then the miners wouldn’t exist because everyone would be a miner, there would be no economic incentive in the sense of the price. As a consequence, I am very skeptical of those companies that are saying: “We created a very efficient blockchain, that contrary to Bitcoin is not wasteful, and that is why we are going to succeed”. To me, they demonstrate that they didn’t understand why Bitcoin succeeded at the start. They will not succeed in my opinion.

Question 11: When to discontinue a project

Considering that resources are finite, and based on the exponential vs linear logic, when and how should we decide to discontinue a project?

It’s not easy. What we are talking about the point where the naysayers are right. The people who come to you and say “Listen, you should give up. You will never succeed. I believed in you, but I must warn you that you only have another 3 months and I am pulling the plug”. The reason why that is also so difficult is because these are never so clean, these are never so easy to understand. You are not able to go to the person and say “Oh, don’t worry. Yes, it is going to take more than three months, but I guarantee that in another 6 months, we will achieve this crossover, and I will demonstrate that your trust was well earned.” And it will be amazing for both of us. You don’t have that kind of data. Sometimes, after the fact you are able to go back, and that is what the business school analysis provides when Clay Christensen writes about disruptive innovation and, for example, quotes digital equipment. It is a beautiful example and a wonderful book, and this kind of analysis is really enlightening.

I don’t know if any of any of you remember but there was a computer company called Digital Equipment Corporation and this company was leader, or one of the leaders, of mini computers, computers of $100, $200 $500 back at the time, and there was a research group that wanted to build a personal computer, and they would never receive the kind of funding that they were asking for because, and this was perfectly true, the directors that needed to approve the funding would always say: “Listen, your computers, your toys, don’t satisfy our clients needs”. And they kept saying that, and then saying that, and then saying that, and then saying that until their market disappeared, because the personal computer was able to satisfy not only the most basic needs, but even the most demanding needs. Digital Equipment Corporation went bankrupt.

Back to the question: it requires faith and sometimes it requires luck. Sometimes, a good approach from the management point of view is to run parallel experiments, and have those experiments compete with each other, and then decide what are the winning experiments, and decide what are the ones that should be discontinued. But betting everything on a single innovation is, of course, sometimes the most amazing success because that single innovation can deliver a truly disruptive result. There is no single and simple answer, even though sometimes business books with a short title try to pretend that they have the silver bullet and the solution for everything.

Question 12: Jolting technologies growth

Is there a similar chart for jolting technologies?

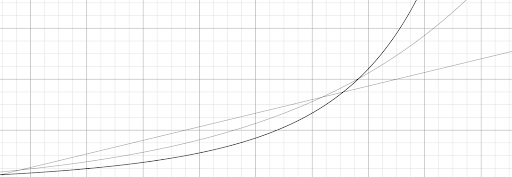

Yes, and it is even more frightening.

This is the chart. The linear line represents linear growth, the slightly curved line represents the exponential growth, and the thick curved line represents the jolting growth. It seems like there is nothing that changes for a long time. And then the change will be so sudden, that even the experts have a hard time keeping up with it. That is why some of the examples that I am citing of exponential technologies are truly hard and truly disruptive. Space exploration, Quantum computers, Artificial Intelligence, but also fusion energy…many, many others that appear as if they were not progressing for literally decades. We have been working on fusion energy for 30-40 years. Artificial Intelligence? We have been working on it for 60-70 years. Quantum computers have been hypothesized 70 years ago by Richard Feynman. And some of these are just now starting to deliver results. In the next course, where you will learn about Artificial Intelligence, I will share with you some results in AI that have astonished even the experts. Some of you may have heard of GPT-3. It’s a new AI system that was released just six months ago, and it completely justified a billion dollar investment by Microsoft in a nonprofit called Open AI, founded by Elon Musk, because the results of GPT-3 are mind boggling. I am not going to spoil it, you will have to watch the videos of the next course. But I’m sure there will be many questions about it as well.

Question 13: Risk assessment for Jolting

Can we talk a little bit more about risk assessment in a Jolting context?

It is very, very frightening and rightly so. It is absolutely rightly frightening. I am 55 and I want to live forever, of course. The probability that I will live forever is close to zero. I am not a religious person. If I were, I could say: “One out of 80 billion, you know, Jesus did not die or died and then then was resurrected”. So I would have at least one example. But not being a religious person, and still wanting to live forever is absolutely crazy. But you know, that’s high end.

However, if I am not going to live forever, statistically speaking, I have three decades, 30 years. I will die. I don’t smoke, but I’m fat, which is not good, but I don’t smoke at least. Let’s say 3 decades, and that’s 2050, right after the Singularity. Which means that by the way, the rules could change, and the robots could look at me and say: “All right, he’s a good guy” and save me. But the question really, is for everyone just to repeat, exponential change is what we are already living in, because it is what created the 20th century. Jolting change has just started, if you wish. And we are now seeing the first examples in reality of Jolting technologies. Jouncing is the next generation, and the reason why I joked about it in the last video, if I remember correctly, in the last unit of the introductory course, is to say that this is a process that is not ending, but also to say that there are limits to what we can realistically understand. I have my wonderful dog, who always follows me, she’s 12 years old, she’s blind. We love each other, and if I asked her: “What I am doing right now”, she would have no way of explaining her understanding. As much as she explained, you and I would realize that her understanding is minuscule with respect of what is going on. And Jouncing technologies really don’t belong to us. They will be amazing. We will literally see magical things in the sky. I don’t know if they will take 10 years or 100 years or thousand years, but with a telescope, we will look out, and the space that today is black, will shine with the consequences of Jouncing technologies lighting up the night sky, across the solar system and beyond. But our ability to intervene and to influence what happens is proportional to our desire to overcome what it means to be human. And the more we overcome that, the more we will be able to embrace that kind of change but potentially others will look at us and say: “Oh, David? Yeah, I remember him. He doesn’t exist anymore. He became something different, something else.” So, thank you for the question, and that is what I think.

Question 14: Business model innovation

How can you recognize when you are in a need of a business model innovation, since the current structure is limiting your products innovation?

It’s very correct to separate product innovation from business model innovation, they are not the same thing and they have their either an individual and separate difficulties, absolutely. And then he connects them together again saying that it is the business model that influences, and in his example negatively, influences the ability for a product to evolve and to be innovated. These two interconnects, and certain products don’t belong to a new kind of business model, a new business model wouldn’t be able to successfully present these products, or the older generation. The easiest is to split the company, and there are enlightened entrepreneurs or even in large companies top management that are able to make that decision. Sometimes, the company that is spun off becomes much more successful exactly because it is not suffering from the limitations of the previous company. Blockbuster had the opportunity of buying Netflix. Yahoo had the opportunity of buying Google. Both of them passed on the opportunity. Would Netflix or Google be what they are today if those acquisitions happened? Absolutely not. They wouldn’t, because inside of those older organizations they wouldn’t have been able to flourish and to blossom the way they have in the past. The way I would answer the question is that the way that you measure a product is to look at, for example, many parameters, but you look at the channels. There is this concept in the startup world called “Product market fit”, and when a startup is not yet ready, then what we say is it hasn’t achieved Product market fit, they don’t know if there are people who are ready to pay for it, if the team is able to develop the product that the people really want, and sometimes to this people add a third component, Product market channel fit. So, what are the channels that are actually available and what are the right avenues to deliver the product to the customers? Since the question doesn’t talk about a startup, but it is likely to refer to an existing company that needs to evaluate when innovation is necessary, it will have existing products serving existing markets through existing channels. Here is where the attention appears the fastest, because it is the channel that typically survives on its ability to deliver the product to the market, and if the producer, the company has healthy margins, many times the channel has much thinner margins. If the product changes to the point where it is not fitting the market anymore or the business model needs to be changed, this is where the attention is going to be. And once again, the example, the innovation in Tesla’s business model includes not only the product, but that they’d have no relationships with established car dealerships. They don’t care about the channel, they only sell direct and as a consequence, bureaucrats currents have prohibited the sale of Tesla in New Mexico, Alabama, South Carolina, Louisiana, and many many other states. You cannot buy a Tesla game in these states in the US. Isn’t that crazy? So, that is what I would say that looking at the channels is the best indicator that there is a need for business model innovation for a given product.